Are you tired of watching your hard-earned money disappear into a vortex of high-interest debt? Do you feel like you’re constantly treading water, barely keeping your head above the rising tide of credit card balances and loan payments? If so, you’re not alone. Many individuals find themselves overwhelmed by the burden of high-interest debt. Fortunately, there’s a potential solution: low-interest debt consolidation. Let's dive in.

Understanding High-Interest Debt

High-interest debt typically includes credit card balances, personal loans with high APRs, and other forms of borrowing where interest rates are significantly higher than the average. These rates can quickly compound, making it difficult to pay down the principal balance. The result? You end up paying far more in interest than you originally borrowed.

The constant accumulation of interest can create a cycle of debt that feels impossible to break. Each month, a significant portion of your payment goes towards interest, leaving little to reduce the actual debt. This is why many people seek alternative solutions.

What is Low-Interest Debt Consolidation?

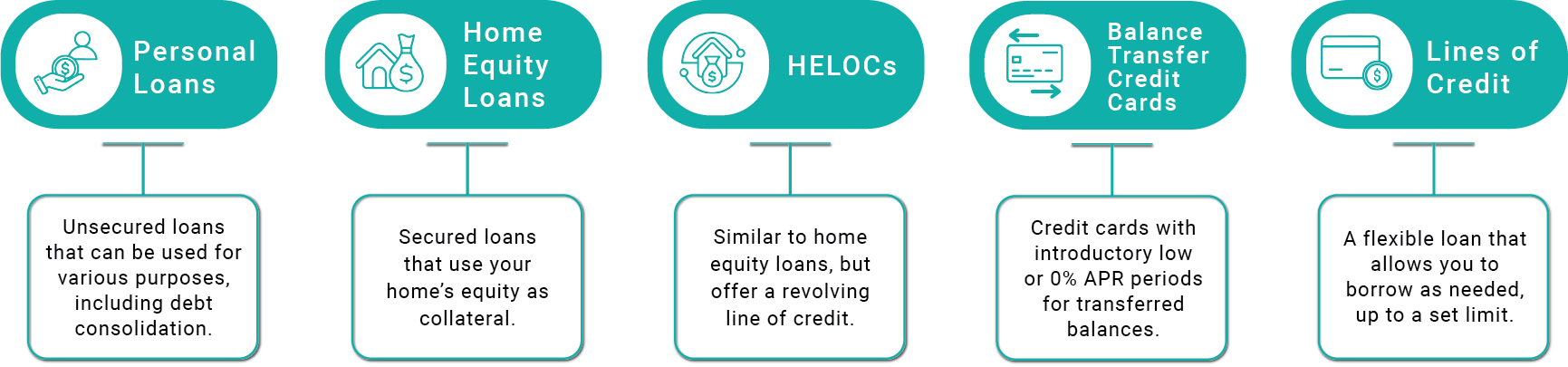

Low-interest debt consolidation involves taking out a new loan or line of credit with a lower interest rate than your existing debts. This new loan is then used to pay off your high-interest debts, leaving you with a single, more manageable monthly payment. Types of consolidation include:

When considering a loan for debt consolidation, pay attention to the loan amount, origination fees, and other loan terms. Remember, terms and conditions are subject to change without notice, so always read the fine print.

Benefits of Low-Interest Debt Consolidation

The primary benefit of debt consolidation is the potential to save money on interest. By securing a lower interest rate, you can significantly reduce the total amount you pay over the life of the loan. Other benefits include: